-

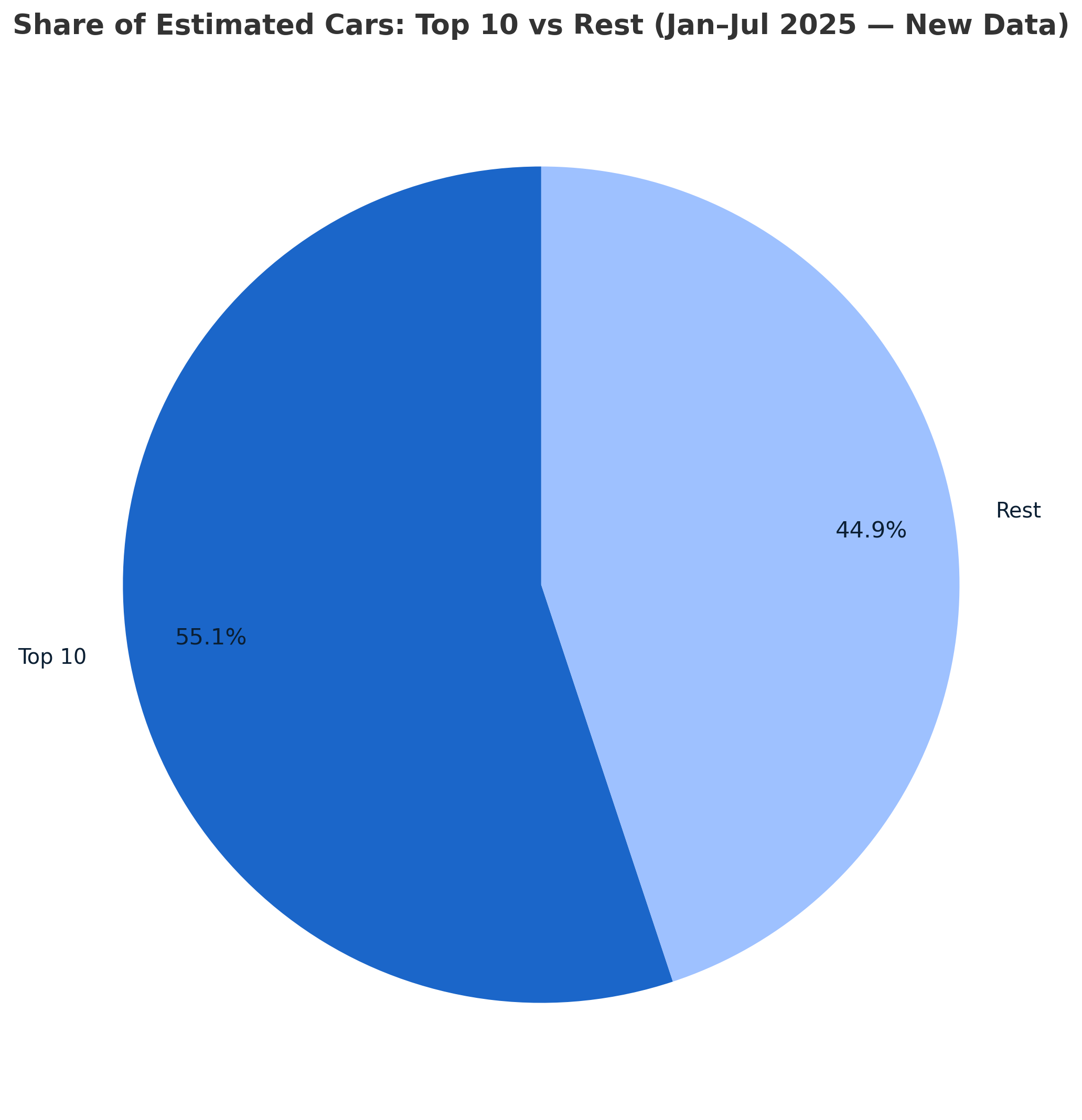

Top 10 total: 429,277 cars

-

All destinations: 779,121 cars

-

Share: 55.1% Top 10, 44.9% Rest

2025 US Car Exports: Top Destinations & Shipping Trends

Containerized car exports from the US are up 17% in January to July 2025. Read our latest car export report to see where American cars are going and the changing demands per country and region for cars from the US.

Key Takeaways (2025 YTD)

- Estimated cars exported ~779,121 in 2025 YTD vs ~667,689 in 2024 YTD → +16.7% YoY.

- Top destinations 2025 YTD: Georgia, Lithuania, UAE, Libya, Netherlands, Germany, Nigeria, Honduras, Australia, Oman.

- Largest risers: Lithuania, Georgia, Netherlands, Nigeria, Libya.

- Largest declines: Spain, Belgium, Germany, Morocco, (plus a few smaller EU lanes).

| Region | 2025 Cars | 2024 Cars | YoY Cars | YoY % |

|---|---|---|---|---|

| Europe | 314,719 | 306,818 | +7,900 | +2.6% |

| Africa | 135,012 | 70,171 | +64,841 | +92.4% |

| Middle East | 124,326 | 103,081 | +21,244 | +20.6% |

| Americas | 106,316 | 94,313 | +12,003 | +12.7% |

| Asia | 77,498 | 82,091 | −4,594 | −5.6% |

| Oceania | 18,865 | 6,502 | +12,362 | +190.1% |

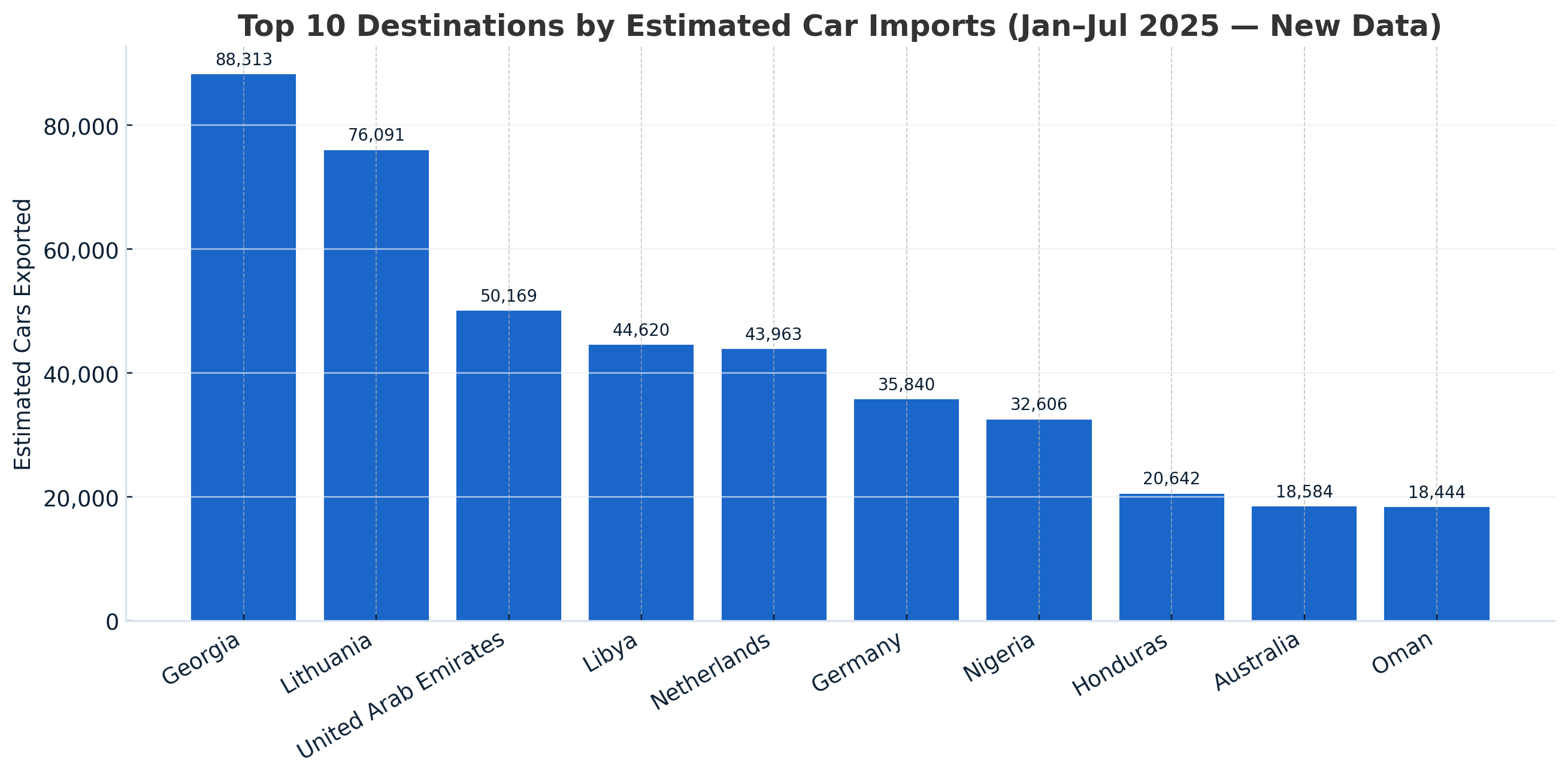

Top Destinations for US Vehicle Exports in 2025 (YTD)

These markets are absorbing the most US vehicles so far this year.

Oct 2025. Source: Trademo export analytics (Jan–Jul YoY, quarterly trends).

Top-10 snapshot:

-

Georgia: 88,313 cars

-

Lithuania: 76,092 cars

-

United Arab Emirates: 50,170 cars

-

Libya: 44,621 cars

-

Netherlands: 43,963 cars

-

Germany: 35,840 cars

-

Nigeria: 32,606 cars

-

Honduras: 20,642 cars

-

Australia: 18,584 cars

-

Oman: 18,445 cars

Totals: Top-10 = 429,276 cars (55.1% of 779,122 across all destinations YTD).

Country spotlights

-

Ship a car to Georgia (country): Active remarketing hub; fast container turnarounds from U.S. East/West Coast.

-

Ship a car to Lithuania: Baltic gateway into EU; strong demand and reliable trans-shipment.

-

Ship a car to UAE: Stable GCC hub for regional distribution (KSA, Oman, Qatar).

-

Ship a car to Libya & Nigeria: Security-minded consolidations for salvage/rebuild buyers; predictable costs in shared 40’s.

-

Ship a car to the Netherlands: NL is up YoY; easy customs and inland trucking across the EU.

Why this matters:

For international car shipping, stronger lanes typically mean more frequent consolidated containers, steadier ETAs, and better unit economics for shared 40’ loads—ideal for classic cars, dealer purchases, and wholesale moves. Learn more about options on our International Car Shipping page and our guide to Consolidated vs Dedicated Container Shipping.

Concentration: Top 10 vs All Other Markets

Oct 2025. Source: Trademo export analytics (Jan–Jul YoY, quarterly trends).

What we’re seeing

A majority share is concentrated in the top ten. For volume shippers and dealerships, that concentration supports steadier weekly departures and faster yard-to-port cycles. For one-off retail moves, it means more opportunities to join an in-progress consolidation from our California or New Jersey facilities.

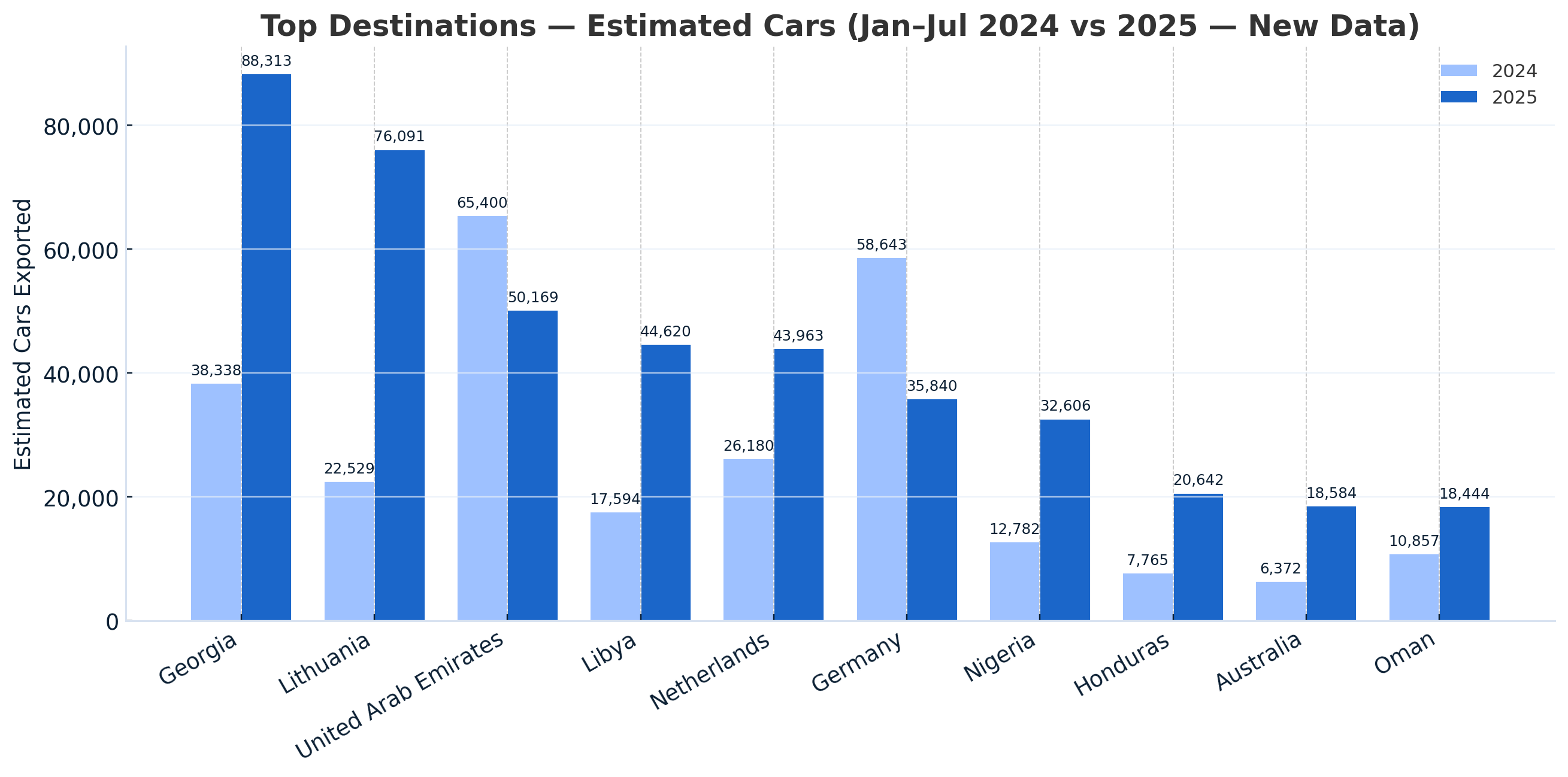

YTD Year-over-Year Movers

Biggest risers (absolute gain in estimated cars):

-

Lithuania +53.6k (+238%)

-

Georgia +50.0k (+130%)

-

Libya +27.0k (+154%)

-

Nigeria +19.8k (+155%)

-

Netherlands +17.8k (+68%)

Largest declines:

-

Spain −46.4k (−92%)

-

Italy −37.1k (−94%)

-

Belgium −27.3k (−76%)

-

Germany −22.8k (−39%)

-

Morocco −17.7k (−95%)

Oct 2025. Source: Trademo export analytics (Jan–Jul YoY, quarterly trends).

How to act on this

- EU access via NL. With Spain/Italy/Germany down YoY but

Netherlands up, route via NL for reliable trans-shipment and quick inland delivery across the EU. Book earlier around quarter-ends when space tightens. - Caucasus & Baltics. Georgia and Lithuania are high-growth hubs; lock space in shared 40’ containers and keep documents ready to hit cut-offs.

- West Africa & MENA. Nigeria and Libya are surging; use consolidations to control cost while keeping security high—ideal for salvage/rebuild projects.

- GCC / UAE. UAE remains a stable hub; consider it for multi-stop Middle East distribution when timing is flexible.

- Americas / APAC adds. Honduras and Australia are now in the Top-10; plan earlier for roll-ups from the East/West Coast respectively and factor local biosecurity/cleaning requirements for AU.

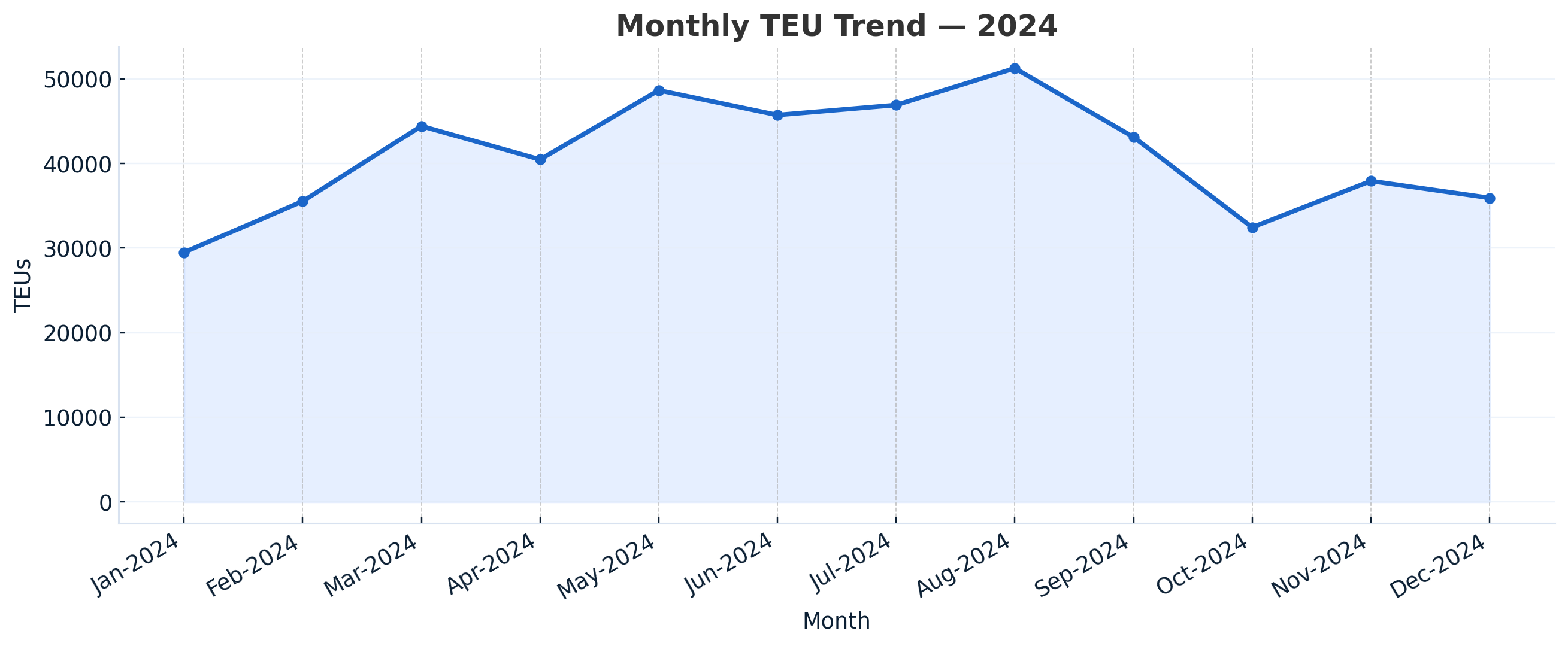

Monthly Trends & Seasonality

2024 Full-Year Momentum (Reported TEUs)

Oct 2025. Source: Trademo export analytics (Jan–Jul YoY, quarterly trends).

Read: 2024 Strength built into Q2 (92,739 TEU) and held through Q3 (30,889 TEU on partial lanes in this slice), consistent with spring loading for summer arrivals and softening later in the year.

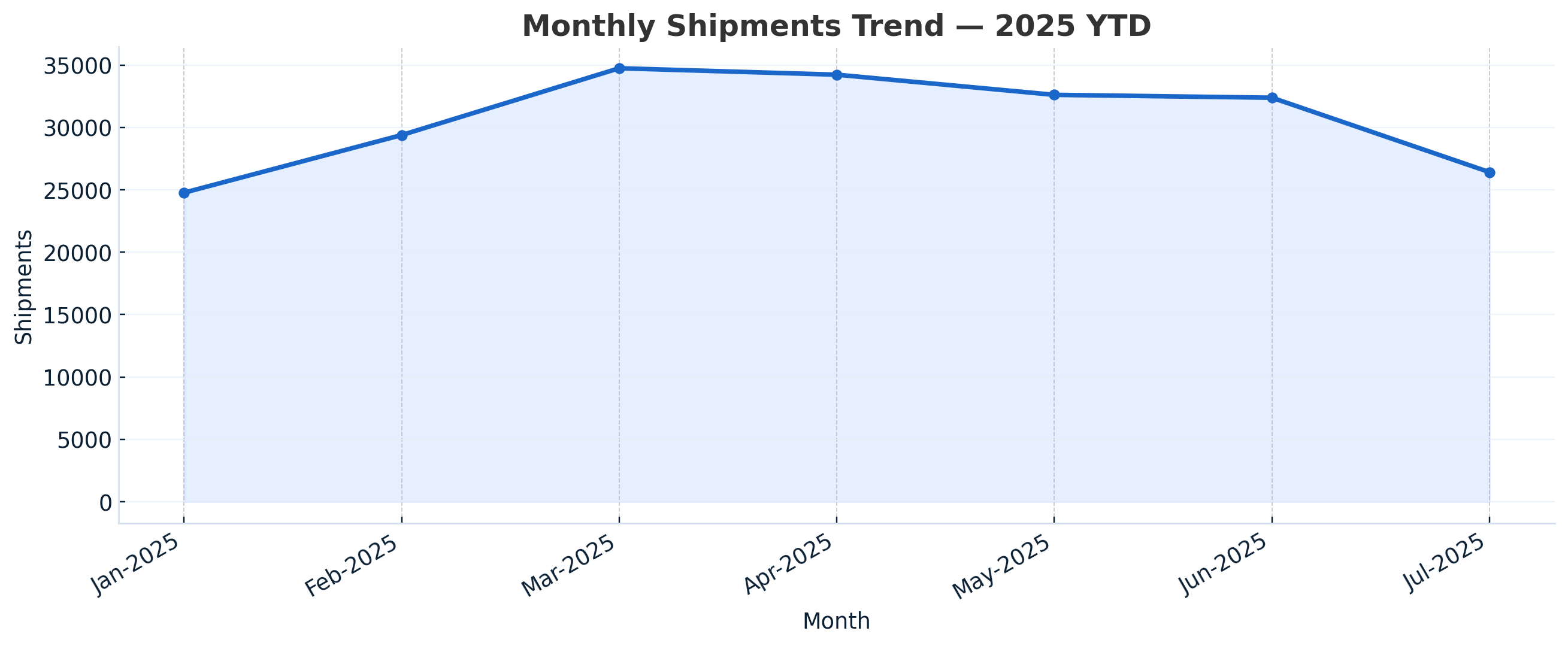

2025 YTD Cadence (Reported Shipments)

Oct 2025. Source: Trademo export analytics (Jan–Jul YoY, quarterly trends).

Read: 2025 is balanced Q1–Q2 (58,091 → 57,453 shipments) with a lighter Q3 so far (14,314 captured in this export). Expect brisk capacity on hot lanes, but space tightens near quarter-ends.

Final insights (Monthly Trends & Seasonality)

- Peak window holds. 2024 peaked into Q2/Q3; 2025 is tracking a solid Q1–Q2 with a Q3 dip—book earlier for late-summer/fall deliveries.

- Booking cadence. Faster shared-container turnarounds Mar–Sep; reserve 2–4 weeks earlier on Georgia, Lithuania, NL, Nigeria, Libya.

- Capacity signal. 2025 YTD is ~16–17% above 2024 YTD in cars; expect tighter space near quarter-ends on Top-10 lanes.

- Cost timing. Jan–Feb and Oct–Nov shoulder periods tend to have easier space and more flexible consolidations.

- Transit planning. For summer arrivals abroad, target spring departures; for fall deliveries, target late-summer sailings.

- EU routing tip. With Netherlands up while Spain/Italy/Germany eased, route via NL for reliable trans-shipment and overland access across the EU.

Q4 2025 Outlook:

-

Volume: We expect +12–18% YoY to hold into Q4 on Top-10 lanes.

-

Capacity: Space will be tightest near quarter-ends; book 2–4 weeks earlier for Georgia, Lithuania, NL, Nigeria, Libya.

-

Routing: Netherlands remains the safest EU gateway while Southern EU lanes stay softer.

-

Pricing: Shoulder windows (Oct–Nov) usually produce better consolidation cadence and steadier rates.

Practical Shipping Tips (for dealers, wholesalers, collectors & military)

-

Book earlier on hot lanes. High-growth routes (Georgia, Lithuania, Libya, Nigeria, NL) see faster container turnarounds.

-

Choose gateways that cut transit friction. For Europe, Netherlands remains a reliable entry point with robust inland options.

-

Use consolidated containers for cost control on one-to-three-unit moves; shift to dedicated containers when timing, privacy, or high value justify it.

-

Match method to vehicle and timing: Container for protection, RoRo for drivable budget moves, air freight for time-critical or ultra-high-value cars.

Shipping in 2025

Demand is running ~10% ahead of last year and the busiest lanes are filling fast. Our team can lock space in the next consolidating 40’ container, handle paperwork end-to-end, and route through the best gateways (NL, Caucasus, MENA) for faster delivery. Whether you’re a dealer, wholesaler, classic-car collector, or military shipper—we’ll match the method and schedule to your timeline and budget.

You May Also Like

These Related Stories

.jpg)

US-EU 15% Tariff Deal: Clear Impacts on Auto Logistics

How Much Does It Cost To Import A Car From The UK To The US In 2025?

-093789-edited.png?width=220&height=79&name=wcs_final_logo_(1)-093789-edited.png)