Exporting US Cars Overseas: The Exhange Rate Advantage

In early 2025, the U.S. dollar experienced a notable decline against major currencies such as the euro, British pound, and Japanese yen. This shift, largely influenced by tariff policies and market reactions, has profound implications for the global automotive industry. For exporters, importers, and logistics providers, understanding these currency movements is essential to navigating international car shipping and trade effectively.

Export Opportunity: US Car Sellers' Currency Advantage

The dramatic 6% drop in USD value against major currencies has created an unprecedented opportunity for US-based car sellers and exporters. An American classic car valued at $50,000 in March would now effectively cost a European buyer approximately €2,700 less in April due solely to currency shifts. When combined with the favorable tariff structures for classics in countries like France, this creates a powerful "double discount" for international buyers.

For US sellers, this means:

-

Higher Profit Margins: Maintain dollar pricing while appearing more competitive in foreign markets

-

Expanded Buyer Pool: Previously hesitant international buyers now find US vehicles newly affordable

-

Accelerated Sales Velocity: Currency advantages often prompt faster purchasing decisions before potential shifts

This window of opportunity could be temporary, as currency markets remain volatile. Savvy sellers are partnering with established international shipping providers to capitalize on this unique market advantage while it lasts.

This trend is particularly notable for classic cars, where Reddit users have noted that Europeans and Canadians are increasingly active in the US market: "As a Canadian, I've noticed that U.S. dealerships are overflowing with inventory" and Americans are rushing to "purchase a new vehicle prior to the implementation of tariffs.

The Scale of the USD Decline Against Major Currencies

Since the beginning of April 2025, the USD has weakened significantly:

-

The USD to EUR exchange rate dropped to approximately 0.88 EUR per USD, its lowest level in three years.

-

The euro surged from around $1.08 to above $1.14 per EUR, marking a gain of nearly 6% against the dollar in just weeks.

-

The USD also hit a 10-year low against the Swiss franc and a three-year low against the Japanese yen.

This rapid depreciation is unusual during periods of economic uncertainty, as the USD typically acts as a "safe haven" currency. However, tariff-induced market volatility and concerns about U.S. economic growth have shifted investor sentiment.

What's Driving the USD Weakness?

Several factors contribute to the dollar's decline:

-

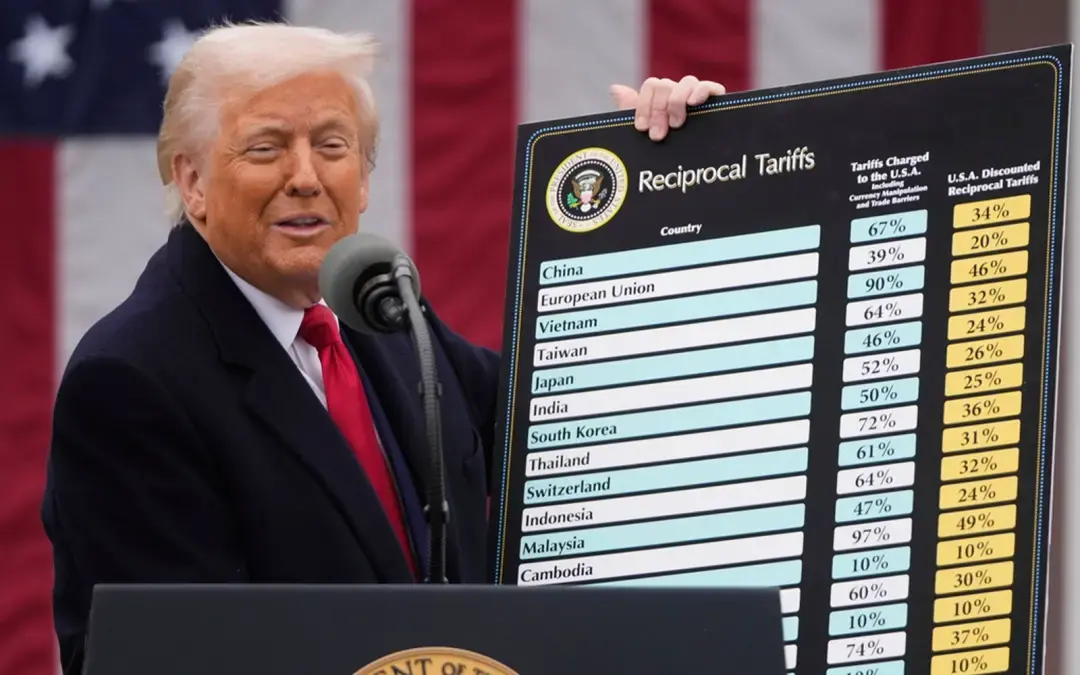

Tariff Uncertainty: The sweeping tariffs introduced in April 2025, including a 25% duty on imported vehicles, have unsettled markets and dampened confidence in U.S. economic prospects.

-

Recession Fears: Investors are increasingly concerned about the risk of a U.S. recession triggered by trade conflicts and inflationary pressures.

-

Capital Repatriation: European and other foreign investors are reallocating assets back to their home markets, reducing demand for USD-denominated investments.

-

De-dollarization Trends: Some analysts warn of a structural shift away from the USD as the dominant global reserve currency due to geopolitical tensions and policy uncertainty.

Implications for the Automotive Industry

The USD's decline against key currencies impacts the automotive sector in several ways:

Increased Cost of Imported Vehicles in the U.S.

For American consumers and dealers importing vehicles priced in euros, pounds, or yen, the weaker dollar means higher purchase prices. For example, a European luxury car costing €100,000 would cost approximately $114,000 in April 2025 compared to about $108,000 earlier in the year, a near 6% increase purely due to currency shifts.

This currency effect compounds with the recent 25% tariff on imported vehicles, creating a double financial burden for importers. The combined impact means that some European luxury vehicles could see effective price increases of over 30% when both tariffs and currency effects are calculated.

Export Competitiveness of U.S. Automakers

Conversely, U.S. automakers exporting vehicles priced in USD become more price-competitive abroad. A weaker dollar effectively lowers U.S. vehicle prices in foreign markets, potentially boosting demand in Europe, Asia, and other regions. This dynamic may partially offset the impact of retaliatory tariffs imposed by trading partners.

American classic car exporters enjoy a particular advantage, as detailed in our analysis of emerging classic car markets. The combination of a weaker dollar and specialized tariff exemptions for vehicles over 25 years old creates significant opportunities for U.S.-based sellers targeting European collectors.

Supply Chain and Component Costs

Many automotive components are sourced globally and priced in foreign currencies. The USD drop raises the cost of importing parts into the U.S., increasing production costs for American manufacturers. This can squeeze margins or be passed on as higher vehicle prices domestically.

As Benjamin Krieger of CLEPA noted, "Components often cross several borders. When we impose a tariff between the location of vehicle assembly and the source of inputs, it escalates costs." When paired with currency fluctuations, this complexity becomes even more challenging to manage.

Impact on International Car Shipping Costs

Fluctuating currency values affect shipping costs and logistics pricing, which are often denominated in USD or local currencies. Importers and exporters must carefully manage currency risk to avoid unexpected cost increases.

For example, port handling fees in Rotterdam, Antwerp, and Hamburg have effectively increased by 5-7% for American shippers due solely to currency effects. Similarly, insurance premiums quoted in euros have become more expensive for U.S. customers, adding another layer of cost to the international shipping process.

Regional Market Dynamics Amid Currency Shifts

European Market Response

The European automotive sector faces mixed effects from the weaker dollar. While European exporters find their products less competitive in the U.S. market due to both tariffs and currency effects, the potential for increased U.S. exports to Europe has grown.

German manufacturers, which employ around 138,000 workers in the U.S., face particular pressure. As noted by Hildegard Müller of the German Association of the Automotive Industry (VDA), the combination of tariffs and currency fluctuations "will cost growth and prosperity on all sides."

For European consumers, the stronger euro creates potential opportunities to acquire American vehicles at relatively favorable rates, assuming tariff structures remain stable. This has particular relevance for classic car imports from the U.S., which benefit from reduced duties under various European exemption programs.

Asian Market Considerations

The Japanese yen's appreciation against the dollar creates similar dynamics, with Japanese manufacturers facing reduced competitiveness in the U.S. market while potentially gaining advantages in third-country exports where they compete with American products.

As explored in our analysis of Japanese auto tariffs, Japan's zero-tariff policy on vehicle imports, combined with the stronger yen, creates a window of opportunity for U.S. exporters despite the overall challenging trade environment.

Currency Effects on Vehicle Categories

Luxury Vehicles Face the Highest Impact

Premium European brands like BMW, Mercedes-Benz, and Audi face the most significant challenges from the combined currency and tariff effects. With limited ability to absorb costs on already premium-priced products, these manufacturers must either pass costs to consumers or accelerate U.S. production plans.

As one Reddit user noted, "A 100k M2, gg dream car," reflecting the reality that some premium models could become prohibitively expensive for U.S. buyers due to the combined impact of currency shifts and tariffs.

Electric Vehicles Under Additional Pressure

The EV sector faces unique challenges as battery components, often priced in yuan or euros, become more expensive for U.S. manufacturers. This comes at a time when federal EV incentives face uncertainty, potentially squeezing the market from both directions.

For European and Asian EV manufacturers exporting to the U.S., the currency disadvantage compounds existing challenges with tariffs and incentive structures, potentially slowing the global transition to electric mobility.

Classic and Collector Vehicles See Opportunity

One bright spot emerges in the classic car market, where currency shifts create advantages for cross-border transactions. American sellers finding their classic vehicles suddenly more attractive to European and Asian buyers with strengthened currencies.

As detailed in our guide to tariff-free classic car imports, vehicles over 25 years old often qualify for reduced duties or complete exemptions, making them less vulnerable to trade barriers. When combined with favorable currency movements, this creates a unique window of opportunity for collectors on both sides of the Atlantic.

How West Coast Shipping Supports Automotive Trade Amid Currency Volatility

Navigating this complex environment requires expert logistics and financial planning. West Coast Shipping offers tailored international vehicle shipping solutions designed to minimize risks and optimize costs amid currency fluctuations:

-

Transparent Pricing: Our shipping quotes include all duties, taxes, and fees, helping you budget accurately despite exchange rate volatility.

-

Flexible Payment Options: We accept wire transfers and bank deposits, facilitating international payments without costly currency conversion markups.

-

Door-to-Door Service: Minimizes handling and delays, reducing exposure to variable port and inland transport fees affected by currency swings.

-

Customs Brokerage Expertise: Our team ensures compliance with changing tariff and tax regulations, helping avoid costly delays or penalties.

-

Insurance and Cargo Protection: Comprehensive coverage options protect your vehicle's value against transit risks exacerbated by market uncertainty.

Whether you're importing a European luxury car, exporting an American classic, or shipping vehicles to auction events worldwide, West Coast Shipping's expertise ensures your logistics chain remains efficient and cost-effective despite currency and tariff challenges.

Strategic Approaches for Importers and Exporters

Timing Considerations for Vehicle Purchases

For buyers importing vehicles to the U.S., the current environment may warrant accelerating purchases before potential further dollar weakness or tariff implementations. Conversely, U.S. sellers targeting export markets might benefit from slight delays if currency projections suggest continued dollar weakness.

As one automotive forum commenter suggested, "I would speculate that since the United States is the largest importer of European vehicles and Australia ranks around tenth, there are numerous markets available to 'offload' into." This market reality means that timing decisions can significantly impact final costs and availability.

Alternative Sourcing Strategies

Some importers are exploring alternative vehicle sourcing strategies, such as those outlined in our guide to tariff-free imports from Canada and Mexico. While these options don't eliminate currency risks, they may reduce overall costs by avoiding certain tariff impacts.

For classic car enthusiasts, focusing on vehicles that qualify for the 25-year exemption from increased tariffs can provide significant savings even amid currency fluctuations.

Financial Hedging Options

Sophisticated importers and exporters increasingly utilize financial instruments to hedge currency risks. Forward contracts, options, and other financial products can provide certainty in an uncertain environment, though they add complexity and potential costs to transactions.

For individuals and smaller businesses without access to sophisticated financial tools, working with experienced shipping partners who understand these market dynamics becomes even more crucial.

Looking Ahead: Currency and Trade Policy Outlook

Market analysts suggest the USD may remain under pressure in the near term as trade tensions persist and economic growth concerns linger. However, potential easing of tariffs or trade negotiations could stabilize currency markets. Meanwhile, automotive industry players should prepare for continued volatility by leveraging expert shipping partners and financial hedging strategies.

While predictions vary, most analysts expect continued volatility in both currency markets and trade policy through 2025. As noted in our analysis of the 90-day tariff pause, even temporary policy adjustments can create windows of opportunity for strategic vehicle movements.

Conclusion

The sharp decline of the U.S. dollar against major currencies in 2025 is reshaping automotive trade dynamics worldwide. Importers face higher costs, exporters gain competitiveness, and supply chains must adapt to fluctuating component prices. In this challenging environment, partnering with a reliable international vehicle shipping provider like West Coast Shipping is crucial.

Our comprehensive logistics services, transparent pricing, and customs expertise help automotive businesses and collectors navigate currency volatility and tariff complexities with confidence. Contact us today to learn how we can support your international car shipping needs in 2025 and beyond.

You May Also Like

These Related Stories

.jpg)

Top US Muscle Cars to Import in 2025: Tariff Exemptions & Market Trends

Classic Car Exemptions Under The US–Japan Trade Deal: The New 15% Tariff

-093789-edited.png?width=220&height=79&name=wcs_final_logo_(1)-093789-edited.png)